Studienfinanzierung

Wie kann ich mein Studium finanzieren?

Ein Studium eröffnet dir großartige Chancen und gibt dir die Möglichkeit, dein Leben und deine Karriere in genau die Richtung zu lenken, die dich interessiert und erfüllt. Es ist ein Investment in deine Zukunft – und gleichzeitig eine finanzielle Herausforderung, die viel Planung und Organisation benötigt. Denn neben Lebenshaltungskosten kommen an der CODE zusätzlich Studienbeiträge auf dich zu. Das liegt daran, dass wir eine private Hochschule sind und somit keine staatliche, finanzielle Unterstützung bekommen, die es möglich machen würde, günstigere Semesterbeiträge anzubieten.

Wir wissen, dass Studienbeiträge eine große Hürde sein können und möchten dich deshalb unterstützen, realistische Lösungen und einen guten Weg zu finden, wie du dein Studium finanzieren kannst. Wir haben schon viele Studierende begleitet und wertvolle Erfahrungen gesammelt, die dir weiterhelfen und hoffentlich deine Sorgen oder Unsicherheit nehmen können, sodass du dich auf das konzentrieren kannst, was zählt: Lernen und Spaß.

Möglichkeiten zur Studienfinanzierung

In Deutschland gibt es grundsätzlich viele Wege, dein Studium zu finanzieren – und die könnten kaum unterschiedlicher sein. Bei einem Stipendium musst du nichts zurückzahlen, während du bei einem Studienkredit die komplette Summe samt Zinsen zahlst. Daneben gibt es bei uns an der CODE noch zusätzliche Möglichkeiten für die Finanzierung deines Studiums. Jede Option hat verschiedene Voraussetzungen und Bedingungen, deshalb lohnt es sich, einen genaueren Blick darauf zu werfen.

BAföG: Studienfinanzierung durch den Staat

BAföG gehört hierzulande zu den bekanntesten Formen der Studienfinanzierung. Dabei handelt es sich um eine staatliche Förderung für junge Menschen, die Unterstützung bei der Finanzierung ihres Studiums brauchen, da die Studienkosten nicht von Eltern oder Familie bezahlt werden (können). Diese Ausbildungsförderung besteht jeweils zur Hälfte aus einem zinsfreien Kredit und einem staatlichen Zuschuss. Das bedeutet, dass du nur die Hälfte des BAföGs zurückzahlen musst.

Die Rückzahlung beginnt spätestens fünf Jahre nach deinem Studienabschluss und ist auf maximal 10.000 Euro begrenzt. Der BAföG-Höchstsatz für Studierende liegt seit Wintersemester 2024/25 bei 992 €, sofern du nicht bei den Eltern wohnst und keine Familienversicherung mehr möglich ist. Deinen BAföG-Antrag reichst du bei dem BAföG-Amt deiner Hochschule oder dem entsprechenden Studierendenwerk ein. Wie hoch deine Förderung ausfällt, hängt unter anderem vom Einkommen deiner Eltern ab.

Um die finanzielle Unterstützung beanspruchen zu können, müssen jedoch die folgenden Voraussetzungen erfüllt sein:

- Studium an einer staatlichen oder staatlich anerkannten Hochschule wie der CODE

- Studienbeginn vor dem 45. Lebensjahr

- Abschluss des Studiums in der Regelstudienzeit

- kein Fachrichtungswechsel bzw. Studienabbruch

- Einkommen der Eltern liegt unter oder nur knapp über den festgelegten Freibeträgen

Stipendium

Wie zu Beginn erwähnt, sind Stipendien eine angenehme Option der Studienfinanzierung, denn diese musst du nicht zurückzahlen. Stipendien sind dementsprechend sehr beliebt und nicht unbedingt leicht zu bekommen. Trotzdem lohnt es sich, die verschiedenen Stipendien genauer unter die Lupe zu nehmen, denn es gibt eine Vielfalt an Möglichkeiten, für die unterschiedliche Kriterien und Voraussetzungen relevant sind.

Viele denken, dass man dafür einen perfekten Notenschnitt braucht – aber das stimmt nicht (immer). Viel wichtiger ist die Begeisterung für dein Studienfach und wie du diese in deinem Motivationsschreiben zeigst. Auch soziales Engagement wird hoch bewertet. Neben bekannten Programmen wie dem Deutschlandstipendium bietet auch die CODE eigene Stipendien an.

KfW-Studienkredit und Bildungskredit

Eine weitere Finanzierungsmöglichkeit für dein Studium ist ein Studien- bzw. Bildungskredit. Hierbei erhältst du nicht auf einmal eine große Summe, sondern monatliche Auszahlungen, wobei du die volle Summe plus Zinsen zurückzahlen musst. Sowohl die Höhe des Darlehens als auch der Zinssatz und die Rückzahlungsmodalitäten unterscheiden sich von Anbieter zu Anbieter.

Am beliebtesten ist der Studienkredit der KfW , den volljährige Studierende unter 45 Jahren beantragen können. Bei dem Studienkredit erhältst du von der staatlichen KfW-Förderbank monatlich zwischen 100 und 650 Euro. Die Rückzahlung des KfW-Studienkredits erfolgt nach dem Abschluss deines Studiums – spätestens jedoch nach einer Karenzzeit von 18 bis 23 Monaten.

Außerdem gibt es noch den staatlichen Bildungskredit des Bundesverwaltungsamts (BVA). Diesen können Studierende im Bachelor ab dem 3. Fachsemester beantragen, wobei die Fördersumme monatlich zwischen 100 und 300 Euro liegt und maximal 24 Monate ausgezahlt wird. Die Rückzahlung des Bildungskredits beginnt vier Jahre nach der ersten Auszahlung.

Neben diesen beiden gibt es noch einige weitere Anbieter von Studienkrediten. Diese sind jedoch nur lokal erhältlich oder für Studierende bestimmter Studiengänge.

Studien- und Bildungsfonds

Studien- und Bildungsfonds “investieren” in vielversprechende Studierende. Diese erhalten während ihres Studiums monatliche Auszahlungen zur Deckung ihrer Lebenshaltungs- und Studienkosten. Sobald sie in das Berufsleben einsteigen, zahlen sie einen festgelegten Prozentsatz ihres Einkommens an den Fond zurück. Wer später gut verdient, zahlt entsprechend mehr zurück, während für Geringverdienende die Rückzahlungen geringer ausfallen. Die Rückzahlungen fließen dann in die Finanzierung der nächsten Studierenden. Auch bei den Bildungsfonds gibt es verschiedene Anbieter – am bekanntesten ist jedoch die Deutsche Bildung .

Finanzierung in Partnerschaft mit Bcas

Ab Anfang 2025 arbeiten wir mit Bcas zusammen, einem innovativen EdTech-Start-up, das sich der Verringerung sozioökonomischer Barrieren im Bildungsbereich widmet. Ihr Modell Study now, pay later"übernimmt die Studiengebühren für bis zu 18 Monate. Die Rückzahlung ist einkommensabhängig und damit flexibler als traditionelle Darlehen.

Studium selbst finanzieren mit einem Nebenjob

Eine weitere Möglichkeit, dich während deines Studiums zu finanzieren, ist recht naheliegend: ein Nebenjob. Das Studium an der CODE ist grundsätzlich als Vollzeit-Studium konzipiert, trotzdem hast du eine hohe zeitliche Flexibilität. Dadurch, dass du selbst entscheiden kannst, welche Workshops oder Vorlesungen du besuchen möchtest und wann du an deinen Projekten arbeiten möchtest, ist es möglich, dir Zeit für einen Nebenjob zu schaffen – je nachdem, wie zeitaufwendig dieser ist, ist ein Job neben dem Studium aber auch nicht zu unterschätzen. Dazu kommt, dass du natürlich nicht nur allein, sondern oft in Teams arbeitest und du dich deshalb mit deinen Kommiliton:innen abstimmen musst.

Ein großer Vorteil für dich bei der Suche eines passenden Nebenjobs, sei es als Werkstudent:in oder ein Minijob, ist, dass du an der CODE ab Tag 1 praktische Erfahrungen sammelst. Die Fähigkeiten und Learnings, die du nach bereits kurzer Zeit vorweisen kannst, machen die Jobsuche erfahrungsgemäß deutlich leichter. Auch unsere Partner- und Start-Up-Netzwerk kann dir helfen, einen für dich passenden Nebenjob zu finden. Wenn du dann noch darauf achtest, dass du in deinem Job (teilweise) remote und flexibel arbeiten kannst, ist es eine gute Option, um neben dem Studium Geld zu verdienen. Und noch ein kleiner Tipp: Als Werkstudent:in darfst du während des Semester maximal 20 Wochenstunden arbeiten (und mehr wird auch wirklich eng), in den Semesterferien sind jedoch bis zu 40 Wochenstunden möglich. So könntest du diese vorlesungsfreie Zeit nutzen, um mehr zu arbeiten und dich während des Semester zu entlasten.

Ein weiterer Vorteil: Mithilfe eines Jobs finanzierst du dir nicht nur einen Teil des Lebensunterhalts selbst, sondern sammelst auch erste Erfahrungen in der Arbeitswelt. So schaffst du die perfekte Basis für einen erfolgreichen Karrierestart.

Möglichkeiten der Studienfinanzierung unter und über 30 Jahren

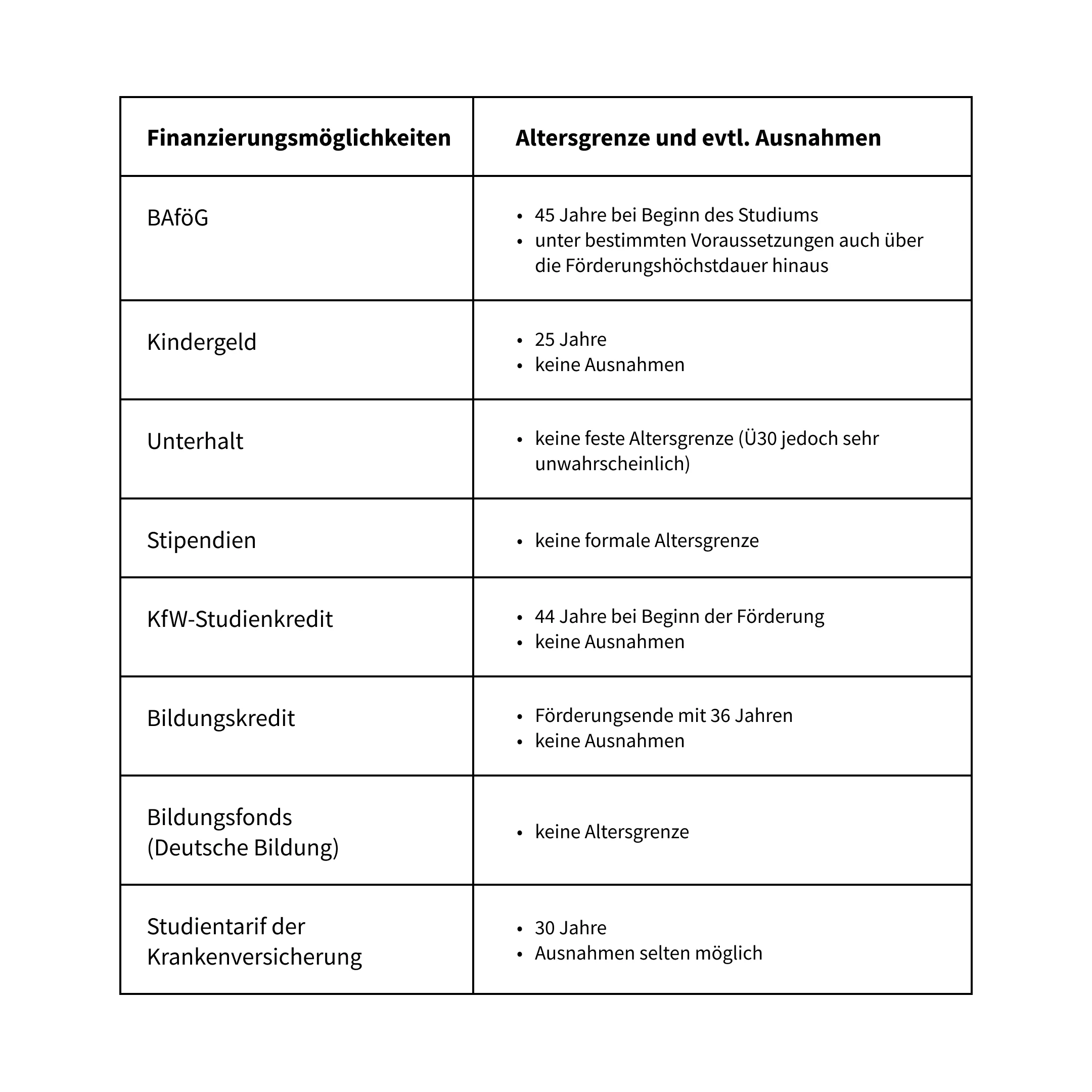

Ein Studium im leicht fortgeschrittenen Alter zu finanzieren, ist oftmals etwas schwieriger, da einige Finanzierungsmöglichkeiten nun nicht mehr zur Verfügung stehen. Welche Altersgrenzen bei den einzelnen Förderprogrammen gelten, erfährst du im Folgenden.

Finanzierungsmöglichkeiten für Studierende aus dem Ausland

Du kommst aus dem Ausland und möchtest an der CODE Berlin studieren? Auch für internationale Studierende gibt es in Deutschland zahlreiche Finanzierungsmöglichkeiten.

Unser Rat an dich

Es ist nicht leicht, sich ein Studium an einer privaten Hochschule wie der CODE selbst zu finanzieren – das wissen wir. Mit unserer Flexibilität und Unterstützung arbeiten wir daran, dass die CODE so zugänglich wie möglich wird, denn eine diverse Studierendenschaft bedeutet uns viel. Wir haben bereits viele Studierende gesehen, die ihren Weg gegangen sind, Finanzierungsmöglichkeiten genutzt und tolle Jobs gefunden haben. Wenn du Zweifel oder Sorgen hast, wende dich gern an unser Admissions Team und wir werden versuchen, dich bestmöglich zu unterstützen.

Fragen?

Wir haben die Antworten. Du kannst dich gerne über admissions@code.berlin an unser Team wenden.